Engineering impact on local economies

Engineering is central to economic opportunity, social progress, and technological advancement across the UK. Yet, the ways in which engineering shapes local economies are as varied as the places themselves. Because engineering roles tend to offer higher wages and productivity, their presence can be a significant asset to local economies. However, the UK’s persistent regional inequalities mean that the benefits of engineering are not evenly distributed.

Place underpins the Academy’s 2030 Strategy, shaping how we deliver our goals. We are committed to strengthening our place-based approach, ensuring that our flagship products and activities respond to national, regional, and global needs.

Through our Regional Hub network (with Hubs now operational in Belfast, Swansea, Glasgow, Liverpool, Newcastle and Sheffield), we will continue to build and mobilise regional and national networks of innovators.

We will also pilot novel approaches to place-based support, responding to each place’s specific context. To better understand how different places can develop and thrive, it is essential to explore the current contribution of engineering to local economies across the country.

This report and the accompanying dashboard enables us to see how much, what type, where and in what context, engineering is happening at the level of local authorities.

The engineering economy

The total engineering economy contributes up to an estimated £747bn direct GVA annually to the UK economy, which is over 33% of total economic output. The engineering economy provides high value, highly productive jobs, where the average value of an individual engineering job, £87,900, is worth almost a quarter more in GVA than the average UK job. Of the 8.5m people working in the engineering economy, 5.9m (69%) are engineers and 2.6m work in a non-engineering role in an engineering business. These vary across the ‘research’, ‘support’ and ‘other’ roles in engineering, containing jobs which provide integral services that underpin the operation of engineering businesses. Engineering businesses overall employ 6.3m people.

Jobs

+ 2.1% change since 2019

685k businesses

+ 5.5% change since 2019

GVA output

+ 5.0%

The size and diversity of engineering means that its employment falls across many different sectors of the UK economy. Engineering plays a pivotal role in construction, manufacturing, metals and mining, and utilities. It also makes up almost 80% of the UK information and communication sector, with roles like software programming and web design, and almost a third of professional, scientific and technical activities, with roles like mechanical and electrical engineers and research and development managers. This diversity and scale emphasises engineering’s national economic importance and influence, underpinning a range of activity from machinery-based to computing and research.

See Figure 4 in the report pdf to see how engineering employment is distributed across the UK’s broad sectors.

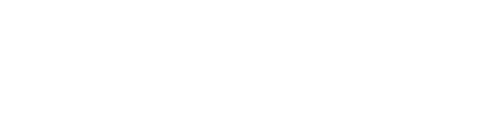

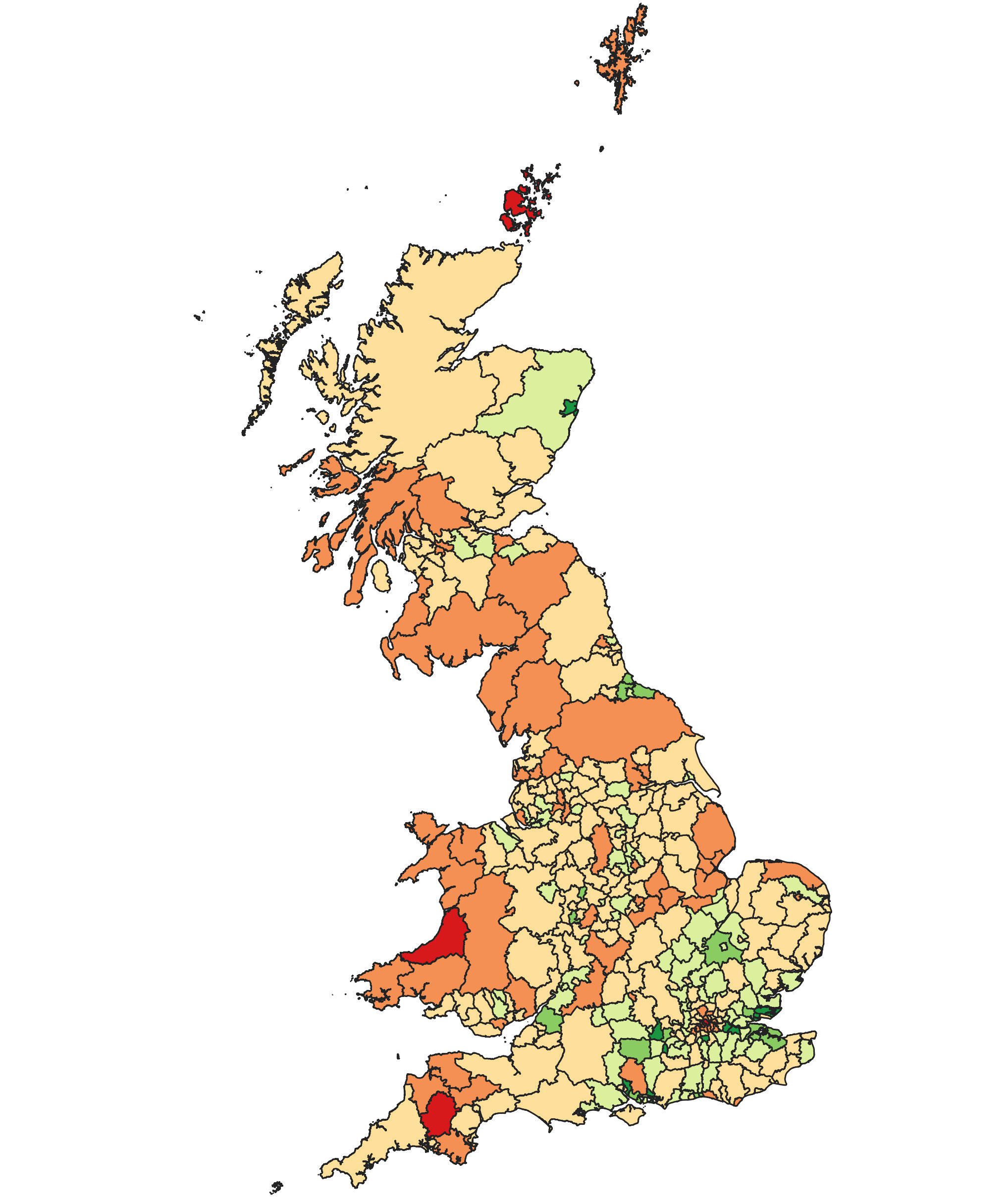

The following maps for England, Scotland and Wales show how the 8.5 million jobs, 685,000 businesses and £747 billion GVA are distributed in local authorities across the UK. (Northern Ireland maps available soon).

As described in the introduction, there are four primary ‘Tier 1’ metrics used to analyse the engineering economy:

- Volume: the total number of jobs in the engineering economy.

- Value: GVA per engineering job.

- Local Significance: the proportion of total local employment that is within the engineering economy.

- Industry Specialisation: the concentration of engineering businesses within a place relative to the UK average (using location quotient analysis).

Each of these are presented as maps below showing the spatial variation of each indicator across Great Britain. This is followed by an additional map which presents the proportion of engineering jobs in R&D by local authority. This was intentionally kept separate from tier 1 metrics to see how R&D levels changed depending upon the dominant engineering economy characteristic.

Volume: The largest changes in engineering employment across places

- Urban centres such as Manchester, Glasgow, and Bristol have seen substantial growth in engineering employment. Darlington and Manchester recorded some of the largest increases outside London, with growth of 30% and 25% respectively and engineering becoming increasingly significant in overall employment.

- Significant expansion has also occurred beyond major cities, particularly across the South West of England, Wales, and the East of England, indicating that engineering employment is still, and becoming even more, geographically dispersed.

- In contrast, several localities in and around London and the South East have experienced marked declines in engineering employment, with 70% of local authorities in South East and London experiencing no growth or declining engineering employment between 2018-2023. While the City of London itself recorded an increase in engineering employment, the wider pattern of engineering employment points to challenges for the sector across London and the South East.

Value

Engineering value,4 measured through growth in GVA per engineering job, presents a mixed picture. Between 2019 and 2023, most high value engineering economies, typically concentrated around South East, London and East of England, saw growth in engineering GVA, strengthening their position, while lower-value engineering economies, particularly in the North of England, have seen further decline.

Notable increases in engineering value have been recorded in localities within the economic influence of major urban centres. For example, Stockport, South Gloucestershire, County Durham, and Knowsley have each experienced some of the highest levels of GVA growth, exceeding that of their respective neighbouring cities of Manchester, Bristol, Newcastle, and Liverpool.

Industry specialisation

The largest changes in industrial specialism across places:

• Industrial specialisation has shown limited growth across the UK. Between 2019 and 2023, about half of all localities experienced either no change or a decline in their level of specialisation.

• Notable increases have been observed in parts of the South West, Wales, and the Central Belt of Scotland, while declines have occurred across the Midlands, North West, and outer areas of London and the South East.

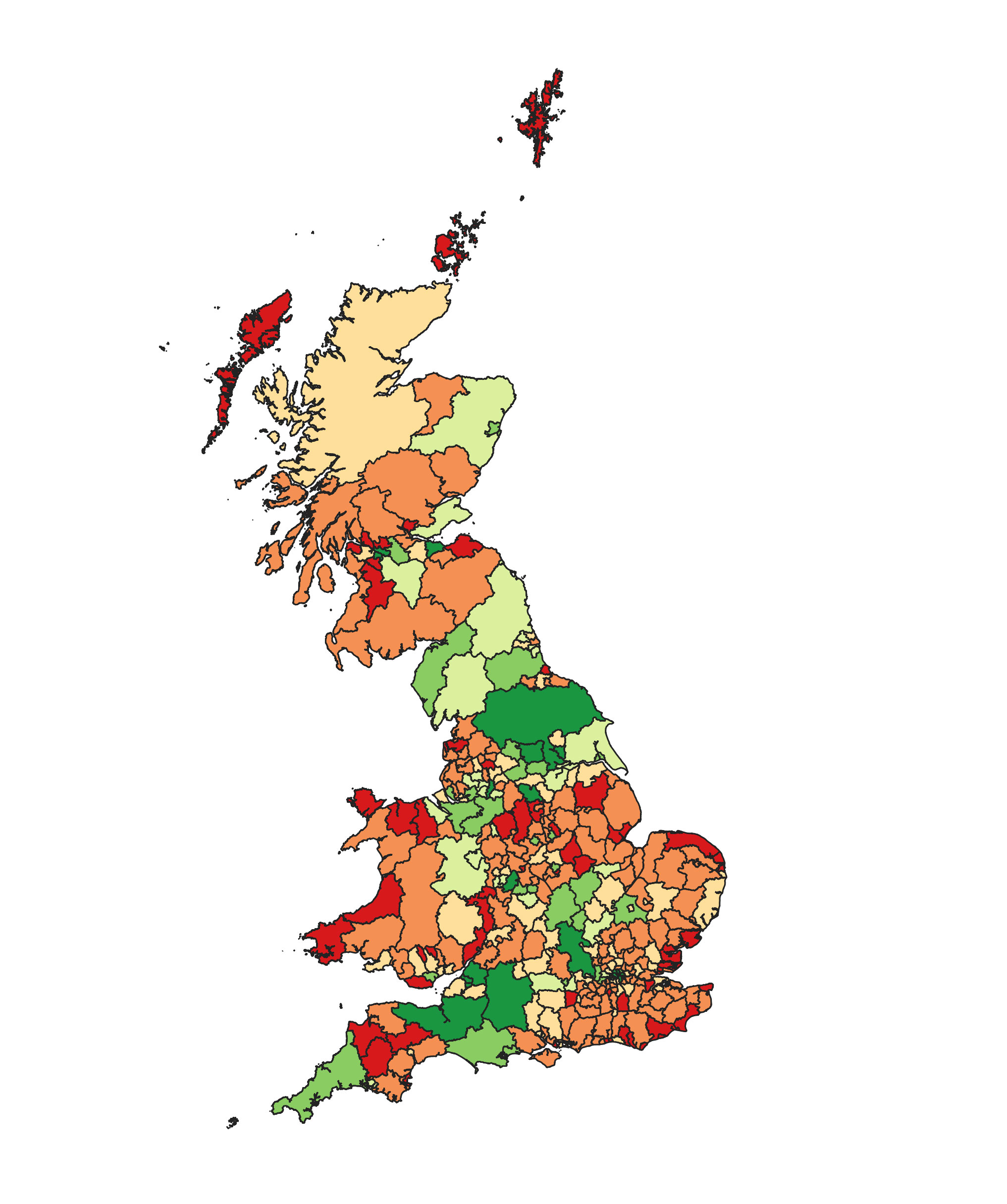

Overall the geography of the engineering typology is similar to the national map in 2019, with the majority of local authorities remaining in the same group. However there are some notable changes, explored through the report, that appear to be signalling real changes to the characteristics of the sector in different parts of the country.

While London and the South East remain dominant, changes in the typology show the engineering economy is not immune to the wider stagnation of the capital’s economy. The update shows signs of strengthening engineering economies beyond the South East, with the emergence of a strong engineering cluster in the West Midlands where the Combined Authority area has seen strong growth across engineering employment, as well as high value engineering and R&D intensive activity.

Edinburgh and its surroundings are emerging as a leading centre of innovation-intensive, high value engineering activity. Changes in typology groups across Edinburgh and the Central Belt towards Glasgow show a stronger role being taken by engineering in these places, and by this area in the UK’s engineering economy.

A typology for Engineering Economy & Place

The typology presented in this section brings together engineering, economy and place features under three themes:

- the engineering economy

- the engineering enterprise

- place economics.

These themes, or tiers of indicators, have been used to categorise all 361 local authorities in the UK. This process, outlined in the report pdf, has identified five broad typology categories. Individual authorities have been grouped together based on shared characteristics and trends, rather than geographical proximity although some within each category share boundaries or regions.

Types of engineering economies in the UK

- High flying innovators: The innovation dominant engineering economies specialising in R&D related activity. These places are collectively high in value and volume and have a high proportion of their engineering jobs in R&D related occupations. They are based in highly populated areas, which are generally more prosperous and engineering businesses are growing in number.

- Embedded engineering: These are economies where engineering is not necessarily dominant but due to the widespread nature and relative high value of engineering, is likely to still have an important role locally as an employment provider and a driver of growth.

- Local engines: A diverse group where engineering plays a very significant role in the local economy, providing at least 25% of overall employment. Some of these places have large engineering businesses which are major employers and have high GVA output, while others have concentrations of engineering businesses but have not been able to transfer this into more significant economic benefit.

- Volume heavyweights: These places contain some of the largest engineering employment footprints in the UK. These combine high-density, high-volume engineering cities with more rural areas where large, high performing firms are located. Combined, they provide a large volume of jobs, equivalent to 27% of the national engineering economy, but the value per job is relatively lower than in value hotspots or high flying innovator places.

- Value hot spots: The high value engineering economies, where jobs are on average worth at least £95,000 in GVA per engineer, £7,000 higher than the engineering economy average. These places are lower in volume and despite their high value, are not seeing widespread growth in their engineering business base. This is instead limited to specific concentrations, many of which are located either around or in key and core cities.