Engineering impact on Ireland's economy

There has long been a consensus in Ireland that engineering is integral to its economy. Developing and deploying the Engineering Economy and Place approach allows us to demonstrate that engineering plays a far greater role in Ireland’s economy than captured by more traditional analyses; but also takes a much more granular view of the role of engineering in the place-specific contexts of the 31 administrative counties.

By sharing this analysis, a new typology framework, place profiles, and an accompanying dashboard tool, this work aims to support policymakers and industry in understanding how the engineering economy creates and distributes value across Ireland. A deeper understanding of engineering within places can inform new policy development and help deliver against existing priorities by building on local strengths and addressing specific needs.

The engineering economy in Ireland

Engineering makes up a major share of Ireland’s economy. In 2022, the engineering economy in Ireland employed 725,000 people, 31% of all employment in Ireland. These are high-value jobs, spread across the whole of the economy, with engineering playing a role in all broad sectors and making a major contribution to employment nationally and in each county. In 2022, the engineering sector accounted for over 1 in 10 (12%) of businesses in Ireland, a smaller share than employment, suggesting engineering businesses are larger on average than non-engineering businesses.

Ireland’s engineering sector has a much higher R&D intensity than the wider economy, with over three times the share of people employed in occupations that are focused on R&D activity. Robust growth has been observed in R&D intensive activities between 2016 and 2022.

The average earnings in the engineering economy in 2022 were €59,300 in 2022, 14% higher than the overall average, indicating that the engineering economy generates a higher value of output on average.

Jobs

+ 2.1% change since 2019

of total employment

businesses

of IRELAND’S TOTAL BUSINESS BASE

Engineering plays a distinct role and exhibits different features in every county across Ireland, reflecting variations in scale, specialisation and local significance. Five core indicators have been used to analyse the engineering economy:

- Volume -total employment in the engineering economy. The report measures the scale of local engineering activity and how closely that reflects population and overall job density.

-

Value - estimated average engineering wage.

- Higher average earnings across the engineering economy suggest that engineering contributes to greater prosperity in places. While there is variation in the size of the gap between average engineering economy wages and the average across all occupations, it is always positive, with higher average earnings in the engineering economy in every administrative county.

- Local Significance: % of total employment in the engineering economy.

- Industrial Specialisation: compares the concentration of engineering businesses in a county to the national average

- R&D intensity - share of engineering jobs in R&D roles. 22% of engineering jobs in Ireland are in R&D occupations with a high degree of variance by place, from 13% in Monaghan to 28% in Dun Laoghaire-Rathdown. The variation in R&D intensity highlights that while engineering is a major part of local economies everywhere, there are large differences in the type of engineering activity taking place.

The typology presented in this section brings together engineering, economy and place features under three themes:

1. Engineering economy

2. Engineering performance

3. Place metrics

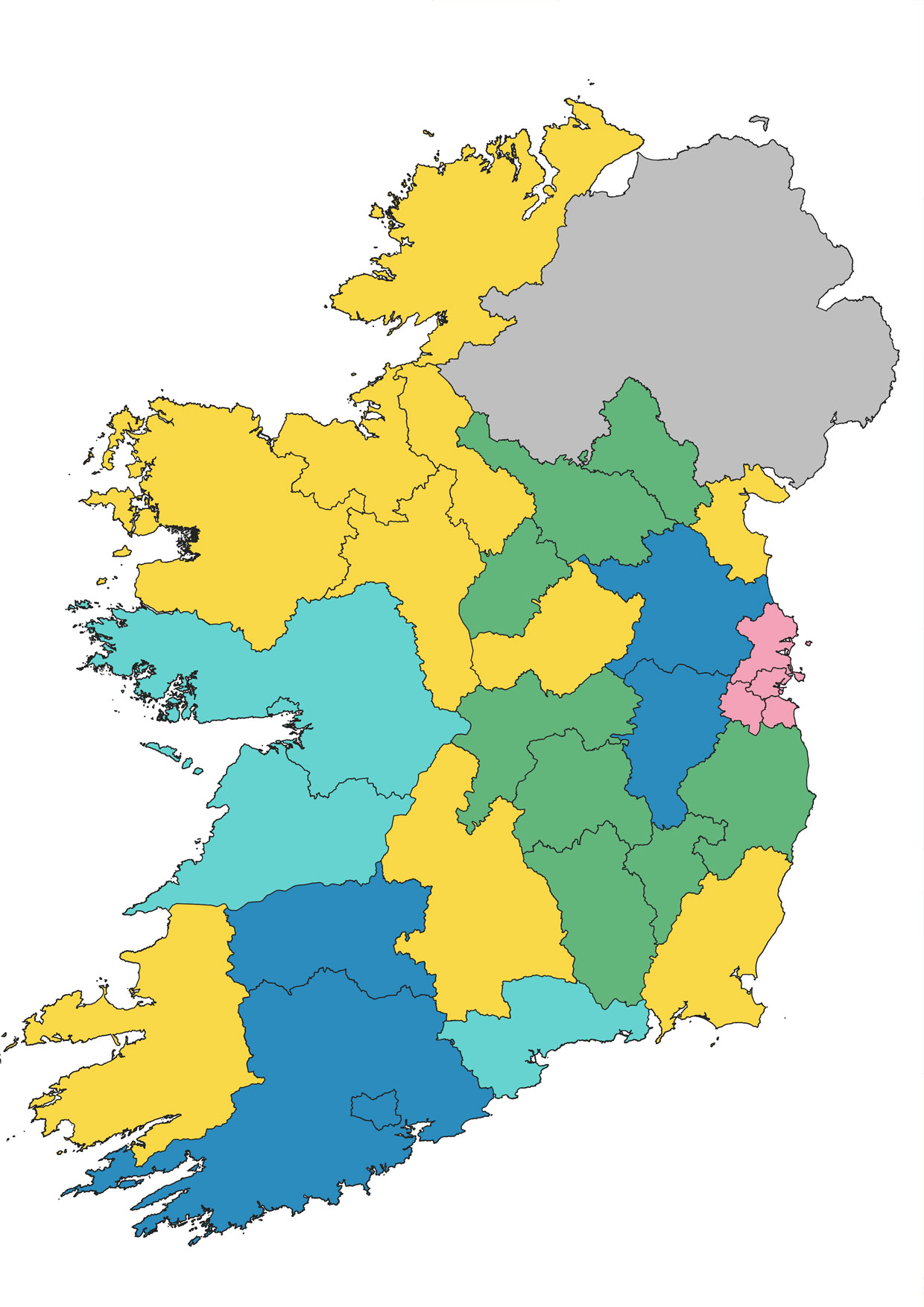

These themes have been used to categorise Ireland’s 31 administrative counties into five typology groups.

Types of engineering economies in Ireland

-

Embedded Engineering: Smaller places where engineering makes up a lower share of the economy than in other groups. While less dominant, engineering still makes up a large share and value (measured by average wages in the sector) in thes places. The average engineering wage is higher compared to other sectors (though the gap is smaller than other places). R&D intensity is low and growing more slowly in this group of places.

-

Local Engines: A group of places where engineering plays a very significant role in the local economy, providing at least 29% of overall employment. The sector is less R&D intensive in these places, with less employment in tech. These are smaller (in population terms) places and employment per business is lower than the average. Wages in engineering are lower than other groups but the sector is still higher playing that the local average (though by less than other places).

-

Industrial Innovator: A small group of places where engineering is a major part of the local economy and where this engineering is R&D intensive, driving innovation in smaller local economies. These are places where manufacturing makes up an important part of the engineering economy, with larger average engineering business (by employment).

-

Engineering Powerhouse: The largest counties outside of Dublin, these are places with well established, high performing engineering economies. Volume and value are high and engineering makes up a high proportion of local employment, with a local significance above 32%. R&D intensity is above the national level on average and foreign-owned companies are a significant part of the local economy. Engineering is strong across each of the four broad sectors: tech, manufacturing, construction & utilities.

-

Tech Heavyweight: This group is a single area, the four administrative counties of Dublin, which collectively account for over a third of total engineering employment and of businesses. However, the scale of the economy in these places overall drives a lower local significance for engineering, which is also dominated by technology. In common with this, and wider economic trends in the area, employment is R&D intensive, and wages are high.